RWT CAPITAL

RWT Capital operates in a high-stakes environment where credibility, insight, and trust directly influence deal flow. The objective of the LinkedIn strategy was to position the firm not just as an advisor, but as a strategic authority in mergers, acquisitions, and capital advisory.

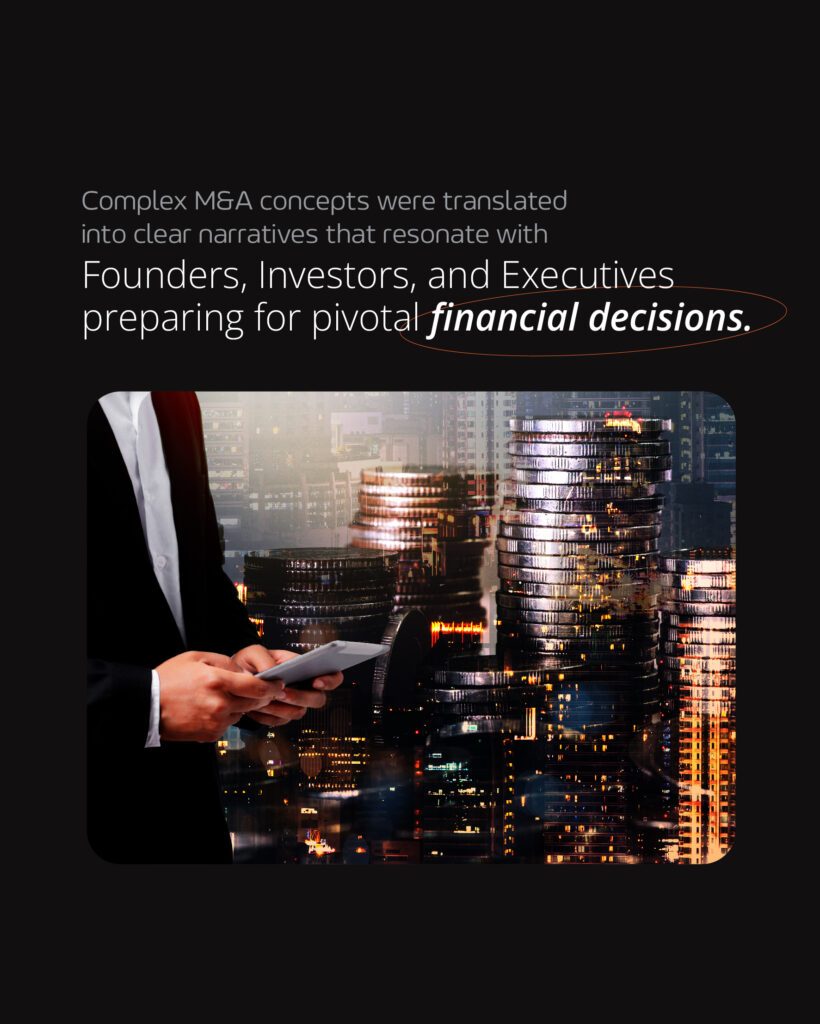

The content direction focused on clarity and confidence. Complex M&A concepts were translated into clear narratives that resonate with founders, investors, and executives preparing for pivotal financial decisions. Rather than promotional messaging, the strategy emphasized thought leadership, market insight, and real-world deal experience to reinforce RWT’s proven track record.

We structured the page to highlight outcomes over services. Smart acquisitions, profitable exits, and disciplined capital strategy became the core themes, supported by messaging that communicated discretion, precision, and execution excellence. This approach helped strengthen RWT Capital’s positioning as a trusted partner throughout the full transaction lifecycle.

As a result, LinkedIn evolved into a credibility channel for RWT Capital, supporting brand authority, increasing relevance among decision-makers, and reinforcing confidence with every interaction, post, and profile visit.

Brand

RWT Capital

Country

Columbia

Industry

Investment Banking

Project Type

LinkedIn Management

LinkedIn Growth

LinkedIn Optimization